Education Is the Best Investment

Financial AidThe money you need to fulfill your dream

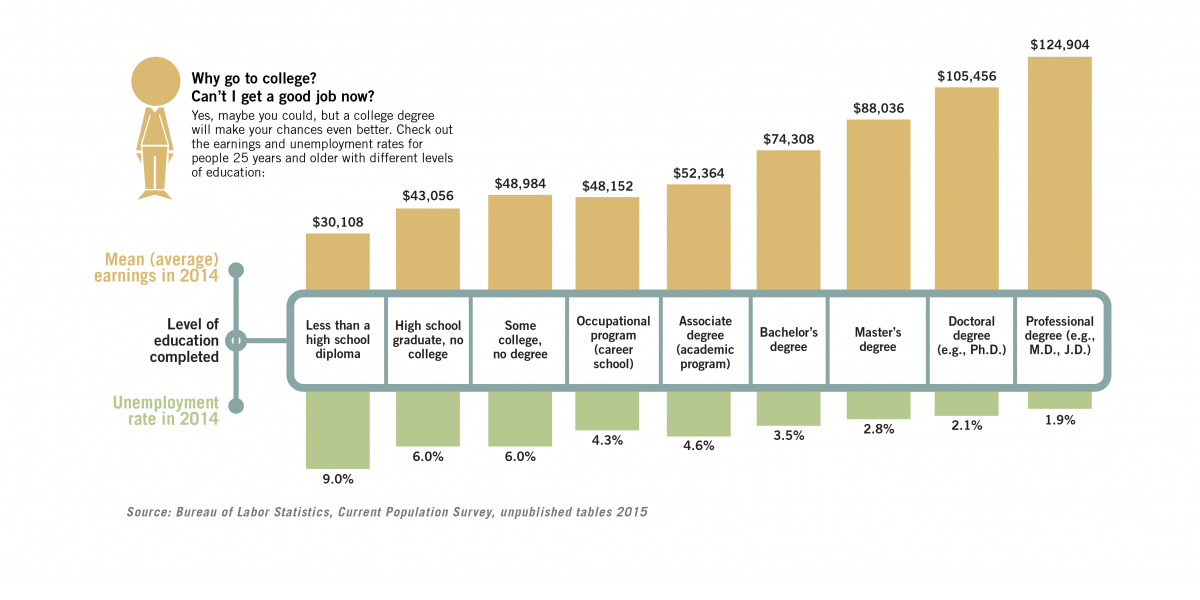

Stated in one of our blog post: “On average, more than 3,000 borrowers default on their federal student loans every day,” and “44 million Americans have a total of 1.4 trillion in student loan debt,” according to a recent CNBC report. Many of these borrowers are projected to be making payments on their loans well into their 40s. Does a college education pay off at the end? Let’s take a look at the following diagram. Who can Earn More?

Sources of Financial Aid for College Education

Source #1: Federal Government

- Grants and Scholarships from the federal government are free money.

- Grants are often need-based; Scholarships are merit-based.

1.Federal Pell Grants

- Only awarded to undergraduate students who have not earn a bachelor’s or professional degree.

- This grant is provided to every eligible undergraduate student.

2.Federal Supplemental Educational Opportunity Grants (FSEOG)

- You can receive $100 to $4,000 a year.

- Contact your school directly.

- Not all schools participate in this grant service.

- Each participated school receives a certain amount of funds each year from the U.S. government and distributes the money to the needed students.

3.Teacher Education Assistance for College and Higher Education (TEACH) Grants

- This grant requires you to take certain kinds of classes, and do a certain kind of job to prevent the grant from turning into a loan.

- Please click HERE for detailed info on “Who can get a TEACH Grant”, “What is a TEACH Grant Agreement to Serve” and “What are the terms and conditions of the TEACH Grant service obligation.”

4.Iraq and Afghanistan Service Grants

- The maximum amount of this grant is $5,920 and can not exceed your cost of attendance for that award year. For more the grants, please click HERE.

- Other resources for military families: Scholarships for Military Families

How to Apply

According to the Department of Education,

You should start by submitting a Free Application for Federal Student Aid (FAFSA®) form. You will have to fill out the FAFSA form every year that you’re in school in order to stay eligible for federal student aid.

For further details on each grant, please connect to the pdf file Federal Student Grant Programs. Usually, you don’t have to pay back. However, you may have to repay a portion or all of the grant funds if

- you withdraw from school before a semester is over;

- your enrollment status changed- from full-time enrollment to part-time;

- you receive other grants or scholarships;

- if you have TEACH Grant, you did not meet its requirements.

Source #2: Your State

Contact the education authorities in your state for resources available to its residents. Your State Contacts

Source #3: Your School

Contact your school’s Financial Aid Office for various types of scholarships, grants, or work-study programs. Related reading: How do schools calculate your financial aid? (by U.S. Department of Education)